28jan26 – Alexandria, VA

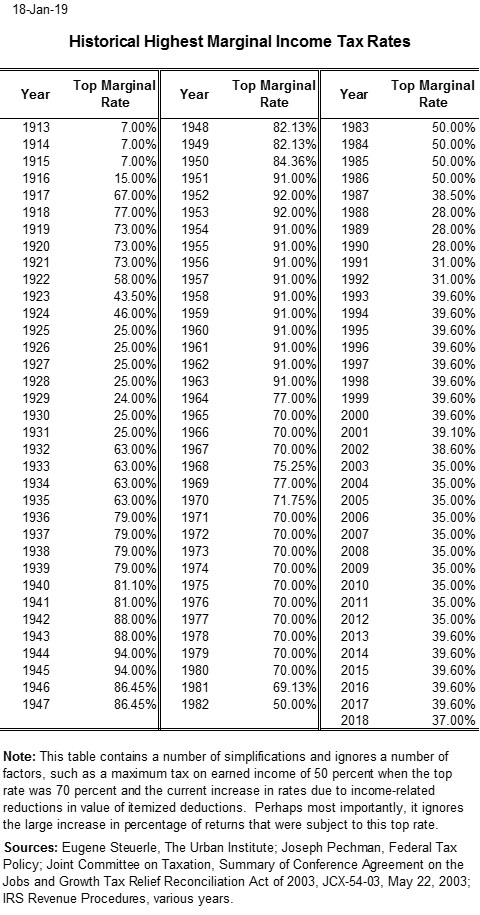

When Regan took office, the top marginal individual income tax rate was 70% and only came down over the ensuing decades to today’s top rate of 37% for single incomes over $640k.

I note that there has been zero lasting correlation between lower income taxes and real GDP growth rate for the last 75 years. The factors driving GDP growth are labor force growth (largely driven by net immigration since the 1980s), total factor productivity (labor and capital) growth, and innovation generated by people and investment. Most of these factors are being sabotaged by those in charge today.

I attach a useful list of the top marginal tax rates between 1913 and 2018. I note that U.S. tax rates and revenues, as a share of GDP, are the lowest of any of the developed countries. Our antipathy toward progressive taxation is unwarranted, particularly since the needs of our ageing society are growing rapidly. Beware of gray power.

Paul

From: Salon <salon-bounces@listserve.com> On Behalf Of Chas Freeman via Salon

Sent: Wednesday, January 28, 2026 12:56 PM

To: salon@listserve.com

Subject: [Salon] Comic taxes!

Salon mailing list

Salon@listserve.com

https://mlm2.listserve.net/mailman/listinfo/salon