Don't forget real estate taxes, which are highly regressive and involve much greater amounts of money. A comparison between federal tax rates and European taxes including VAT is highly misleading. One must include state and local taxes in the mix.On Thu, Jan 29, 2026 at 2:03 PM J P Horne via Salon <salon@listserve.com> wrote:--29jan26 – Alexandria

Right you are about Europe’s recourse to regressive VAT. But then many of our states have substantial sales taxes.

Nevertheless, the OECD notes that the total U.S. tax burden, including Social Security, is much less, as a percent of GDP, than virtually all developed countries.

The other problem is that so many center-right legislators joyously vote for tax cuts, then use the resulting deficit to justify cutting the social safety net.

At a time, when our structural needs are rising sharply and will continue to with demographics, AI, and zero net immigration decimating the labor force and GDP growth. Not to mention climate change’s impact.

No escape: We’re going to have to tighten our belts.

Paul

From: Chessset <chessset@aol.com>

Sent: Thursday, January 29, 2026 4:59 AM

To: horne.jp@verizon.net; 'Chas Freeman' <salon@committeefortherepublic.org>

Subject: Re: [Salon] FW: Comic taxes!

Overall, the US tax system is more progressive than in many European countries because they rely heavily on the VAT, which is highly regressive.

On Wed, Jan 28, 2026 at 6:52 PM, J P Horne via Salon

<salon@listserve.com> wrote:

28jan26 – Alexandria, VA

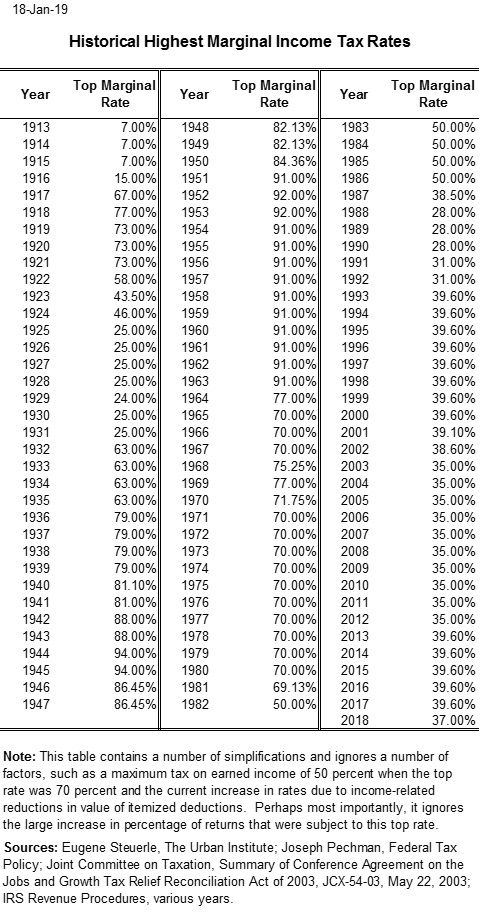

When Regan took office, the top marginal individual income tax rate was 70% and only came down over the ensuing decades to today’s top rate of 37% for single incomes over $640k.

I note that there has been zero lasting correlation between lower income taxes and real GDP growth rate for the last 75 years. The factors driving GDP growth are labor force growth (largely driven by net immigration since the 1980s), total factor productivity (labor and capital) growth, and innovation generated by people and investment. Most of these factors are being sabotaged by those in charge today.

I attach a useful list of the top marginal tax rates between 1913 and 2018. I note that U.S. tax rates and revenues, as a share of GDP, are the lowest of any of the developed countries. Our antipathy toward progressive taxation is unwarranted, particularly since the needs of our ageing society are growing rapidly. Beware of gray power.

Paul

From: Salon <salon-bounces@listserve.com> On Behalf Of Chas Freeman via Salon

Sent: Wednesday, January 28, 2026 12:56 PM

To: salon@listserve.com

Subject: [Salon] Comic taxes!

--

Salon mailing list

Salon@listserve.com

https://mlm2.listserve.net/mailman/listinfo/salon

Salon mailing list

Salon@listserve.com

https://mlm2.listserve.net/mailman/listinfo/salon